There are many transactions in Material Management (MM) that relevant

for Accounting. These transactions must be recorded in accounting

documents that contain the postings made to the G/L accounts in

Financial Accounting (FI). The mostly used MM transactions that relevant

for FI can be seen at Accounting Journals of SAP Material Management (MM) Transactions.

For those transactions, as far as possible, the SAP R/3 System should determine automatically the G/L account numbers that are involved in the accounting journal. By doing so, we can minimize the inputs and error possibilities made by MM end-users who perform the transactions as they don’t determine the G/L account numbers.

We can do this by Automatic Account Determination process in MM configuration (T-code: SPRO). The automatic account determination process must be done together with Accounting Department.

The influencing factors that determine how SAP choose the G/L account numbers that are involved in the accounting journal for MM transactions are:

For those transactions, as far as possible, the SAP R/3 System should determine automatically the G/L account numbers that are involved in the accounting journal. By doing so, we can minimize the inputs and error possibilities made by MM end-users who perform the transactions as they don’t determine the G/L account numbers.

We can do this by Automatic Account Determination process in MM configuration (T-code: SPRO). The automatic account determination process must be done together with Accounting Department.

The influencing factors that determine how SAP choose the G/L account numbers that are involved in the accounting journal for MM transactions are:

- Chart of accounts of the company code

We must assign a chart of account to each company code. Several company codes can use the same chart of accounts. This process must be done in FICO configuration. You can learn how to configure FICO module in its relation with MM module at SAP FICO minimal configuration for MM posting.

SAP R/3 determines the chart of account affected by MM transaction from the company code or plant entered by user when performs a transaction.We must define the automatic account determination individually for each chart of accounts. - Valuation grouping code of the valuation area

See Material Valuation to know more about valuation area. The Valuation grouping code is a key to differentiate account determination by valuation area within a chart of account. Valuation grouping code is also called Valuation modification.

SAP screenshots of How to activate the valuation grouping code(T-code: SPRO / OMWM):

SPRO menu:

IMG – Materials Management-Valuation and Account Assignment – Account Determination – Account Determination Without Wizard-Define Valuation Control

The above image is © SAP AG 2010. All rights reserved

The above image is © SAP AG 2010. All rights reserved

A valuation grouping code consists of a group of valuation areas that can have same account determination in a specific chart of account. It is a tool that enables us to configure the automatic account determination with a minimum of effort.

If we activate the valuation grouping code in configuration process, we have to assign a valuation grouping code to each valuation area.

SAP Screenshots of How to define valuation grouping code (T-code: SPRO / OMWD):

SPRO menu: IMG – Materials Management-Valuation and Account Assignment – Account Determination – Account Determination Without Wizard – Group Together Valuation Areas.

The above image is © SAP AG 2010. All rights reserved

The above image is © SAP AG 2010. All rights reserved

By activating and using the valuation grouping code, we don’t have to configure account determination for each valuation area (that is a plant or company code) if we don’t want to differentiate it for each valuation area. If we want the automatic account determination within a chart of accounts runs differently for valuation areas, we can assign different valuation grouping codes to these valuation areas.

We must define the automatic account determination individually for every valuation grouping code within a chart of accounts. It applies to all valuation areas which are assigned to this valuation grouping code.

For example, if we want to differentiate the account determination for a group of two plants with another group of other three plants in a company code (where the valuation level is plant), we can assign a valuation grouping code for the group of two plants and another valuation grouping code for the group of other three plants. By doing so, we just have to configure the account determination for the two valuation grouping codes, no need for five valuation areas (plants).

SAP R/3 determines the valuation area and the valuation grouping code affected by MM transaction from the company code or plant entered by user when performs a transaction. - Valuation class of material

The valuation class is a key to differentiate account determination by materials. For example, we can post a goods receipt of a raw material to a different inventory account than if the goods receipt were for finished-product.

We can do this by assigning different valuation classes to the raw material and finished-product and by assigning different G/L accounts to the posting transaction for every valuation class. If we don’t want to differentiate account determination according to valuation classes we don’t have to maintain a valuation class for a transaction.

The valuation class must be entered in the accounting data view of material master data for a valuated-material. The allowed valuation classes for a material depend on its material type. More than one valuation class can be allowed for a material type. More than one material type can be allowed for a valuation class. The relationship between valuation classes and material types is established by the account category reference. The account category reference is a compilation of valuation classes. A material type is assigned to only one account category reference.

SAP screenshots of How to define valuation classes (T-code: SPRO / OMSK)

SPRO menu: IMG – Materials Management-Valuation and Account Assignment – Account Determination – Account Determination Without Wizard-Define Valuation Classes.

The above image is © SAP AG 2010. All rights reserved

The above image is © SAP AG 2010. All rights reserved

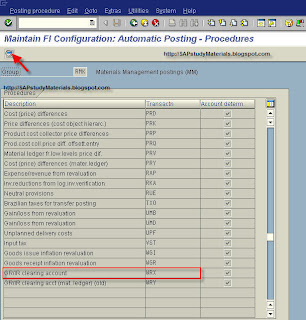

- Transaction/event key (internal processing key)

The Transaction/event key is a key to differentiate account determination by business transaction. For example, we must differentiate G/L account posted by goods receipt transaction and posted by invoice receipt transaction.

Posting transactions are predefined for those inventory management and invoice verification transactions relevant to accounting. Posting records, which are generalized in the value string, are assigned to each relevant movement type in inventory management and each transaction in invoice verification. These contain keys for the relevant posting transaction (for example, inventory posting and consumption posting) instead of actual G/L account numbers.

We do not have to define these transaction keys, they are determined automatically from the transaction (invoice verification) or the movement type (inventory management). All we have to do is assign the relevant G/L account to each posting transaction.

- Account grouping(only for transaction: offsetting entries, consignment liabilities, and price differences)

Account grouping is a key that allows us to subdivide number assignments for each transaction key in account determination.

Account grouping is also called general modification. Since the posting transaction “Offsetting entry for inventory posting” is used for different transactions (for example, goods issue, scrapping, physical inventory), which are assigned to different accounts (for example, consumption account, scrapping, expense/income from inventory differences), it is necessary to divide the posting transaction according to a further key: account grouping code.

An account grouping is assigned to each movement type in inventory management which uses the posting transaction “Offsetting entry for inventory posting”. Under the posting transaction “Offsetting entry for inventory posting”, we must assign G/L accounts for every account grouping, that is, assign G/L accounts.

If we wish to post price differences to different price difference accounts in the case of goods receipts for purchase orders, goods receipts for orders, or other movements, we can define different account grouping codes for the transaction key.

Using the account grouping, we can also have different accounts for consignment liabilities and pipeline liabilities.

You can see list of account grouping here.

Automatic

Postings are postings made to G/L accounts automatically in the case of

Invoice Verification and Inventory Management transactions relevant to

Financial and Cost Accounting.

When

entering the goods movement, the user does not have to enter a G/L

account, since the SAP R/3 System automatically finds the accounts to

which postings are to be made using the influence factors as explain

above.

- Posting made in the case of goods receipt (GR) to purchase order (PO):

|

Inventory account

|

GR/IR Clearing Account

|

|||

|

500

|

500

|

|||

We need to update the BSX transaction key (Inventory posting) with the GL code Inventory account.

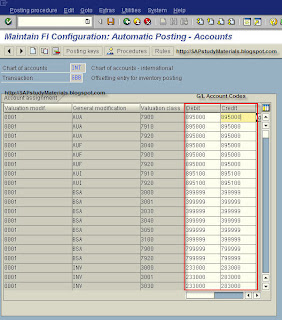

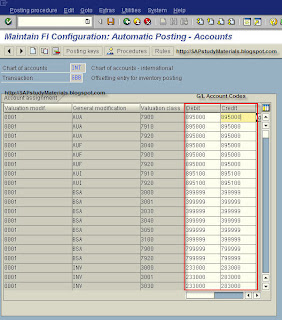

SPRO menu:

SPRO menu:

IMG

– Materials Management-Valuation and Account Assignment – Account

Determination – Account Determination Without Wizard – Configure

Automatic Posting.

Enter Chart

of Account which we want to configure its account determination, then

enter the G/L account affected by the transaction as below:

We also need to update the WRX transaction key with the GL code GR/IR Clearing account.

Enter Chart

of Account which we want to configure its account determination, then

enter the G/L account affected by the transaction as below:

- posting made in the case of goods issue to cost center:

|

Inventory account

|

Material consumption

expense account

|

|||

|

500

|

500

|

|||

We have configured the inventory posting transaction in the previous section (GR to PO).

Now, we have

to configure transaction key GBB. GBB key is used for various

offsetting posting entries. Within GBB transaction there are various

account grouping (general modification). In this case we need to update

general modification VBR with the material consumption expense account.

Enter Chart

of Account which we want to configure its account determination, then

enter the G/L account affected by the transaction as below:

No comments:

Post a Comment